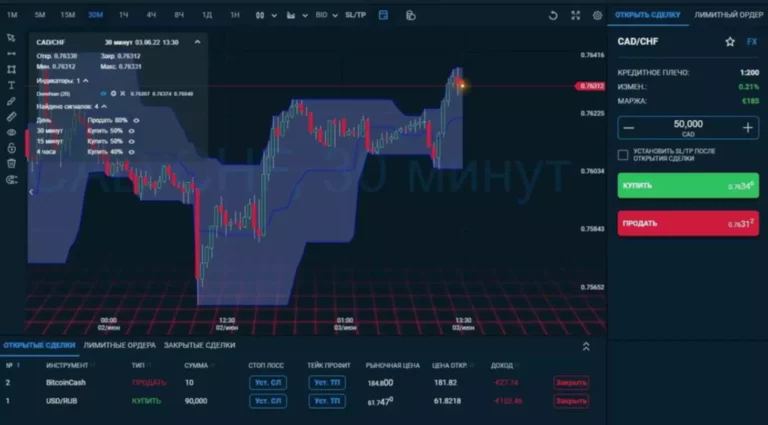

Regarding percentage-based charges, the charge can be between 0.01% to zero.05% of the contract’s total worth. The buyers should examine the structure of fees provided by different brokers and choose the one that may be cost-effective for them and their trading necessities. Choosing a dealer with low charges is an important which brokerage has the lowest fees choice for traders and buyers. Goodwill brokerage calculator is a valuable software for traders to make informed selections.

Check Prices In Your House Cleansing Needs !

In this detailed guide, we’ll take you through the process of creating a Demat account online, spotlight… Another factor to concentrate on is the „Annual maintenance expenses“ (AMC) deducted by the dealer out of your account. If the AMC charge is deducted each month, it can significantly cut back your invested funds over time. In such a situation, it may be more cost-effective to pay a lump sum amount upfront to nullify the month-to-month AMC costs.

Factors To Contemplate Before Selecting A Inventory Broker

So at any given time, they’ll act as a vendor (or agent) or provider (or principal) but not each. Full-service brokers are traditional brokers who tend to charge the next brokerage as they promise to share recommendations on the inventory market as nicely. A discount broker, then again, offers a no-frills entry to the trading terminal and thus, expenses a a lot decrease brokerage. Before investing in detailed market research on the lowest brokerage charges, a demat account in India can be useful.

What Are The Top 10 Paint Firms India?

Remember, brokerage charges and tax regulations may change over time, so staying updated with the newest information is essential for correct financial planning and buying and selling selections. More broker-dealers are opting to do these capabilities themselves quite than by means of a clearing firm. As such, they will normally cost between $25-$55 per account annually as an alternative of charging a share of property. Most companies’ merchants would act as each brokers and sellers and are subsequently often known as broker-dealers by enterprise regulators. In India, Securities Transaction Tax (STT) is payable on the worth of securities transacted through a inventory trade. It is a tax paid on the entire quantity paid or received in a share transaction.

Are Low Cost Brokerage And Nil Brokerage The Same?

Full-service brokers charge a percentage of the commerce value as brokerage charge, which may differ depending on the sort of service, product, or phase. Another significant factor influencing brokerage, whether calculated manually or utilizing a brokerage calculator, is the volume of your transactions. Generally, bigger transaction volumes lead to greater brokerage quantities. However, some brokers may reduce the proportion commission for buyers who trade in large quantities.

How The Brokerage Calculator Helps In Making Cost-efficient Selections

Brokerages are used to enter the securities market for a charge, generally known as a brokerage is a fee, which facilitates the shopping for and promoting of financial devices like stocks in India. In India, brokerage costs range up to 0.5% of the transaction value. If the share is value Rs 10,000 and the brokerage payment is zero.1%, the total amount comes to Rs 10. It provides access to trading platforms, permitting you to have interaction with stocks, bonds, commodities, and more.

Apply For A License To Become A Business Dealer

- The actual rate varies relying on the broker’s coverage and the kind of transaction involved.

- Though this report is disseminated to all the customers simultaneously, not all customers could obtain this report on the same time.

- Things have turn out to be quite simple and you can find a property by yourself.

- Understanding the fundamentals of brokerage empowers you to choose the proper one on your on-line buying and selling wants whereas ensuring you know how the entity capabilities.

- Because they assist you to with every step of the process, from in search of housing to finalising the contract.

The precise costs may differ from one broker to another and depend upon several different components, just like the commerce worth or the sort of commerce taken. Rapid progress has been witnessed within the financial market of India, with an innumerable number of retail buyers entering the market. For these traders, online buying and selling has turn into a recognised possibility who are looking forward to buying and selling in commodities, currencies, stocks, and derivatives. Give your trades and investments a greater and enhanced platform with zero brokerage. Be it intraday trades or long-term inventory investments, manage everything at zero brokerage for all times with m.Stock by Mirae Asset.

Distinction Between Fee And Brokerage

It’s essential to explore different brokers and evaluate them to find one of the best one for you based by yourself criteria and preferences. In this blog, we are going to reply these questions and introduce you to some of the best brokers with the bottom brokerage costs in India. We may also clarify what makes them stand out from the remaining and the way they can help you to save money and enhance your earnings.

These charges are levied by the change on which the commerce is made. Stock Exchanges in India are privately owned companies and Exchange Transaction Charges are arguably their biggest supply of revenues. BSE costs Rs. 2.75 per lakh whereas NSE expenses Rs. three.25 per lakh on turnover for fairness transactions.

Brokerage expenses influence funding selections in the inventory market and may affect long-term investors. Goodwill is a vital option to contemplate when choosing a brokerage firm. A wirehouse or full-service broker-dealer encompasses small brokerages and monetary behemoths with its personal line of products it presents clients for income. Traditionally, most buyers and merchants needed to pay fees to their brokers to execute trades and preserve their accounts. Because low cost brokers offer a narrower selection of merchandise and supply no investment advice, they cost decrease fees than full-service brokers do. A fee could possibly be any fee that you pay for a transaction or service rendered.

The account opening course of will be carried out on Vested platform and Bajaj Financial Securities Limited will not have any position in it. Investments within the securities market are subject to market threat, read all related documents fastidiously earlier than investing. Just write the checking account quantity and signal in the software type to authorise your financial institution to make fee in case of allotment. “Investments in securities market are topic to market risk, read all of the scheme related documents carefully earlier than investing.“

Read more about https://www.xcritical.in/ here.